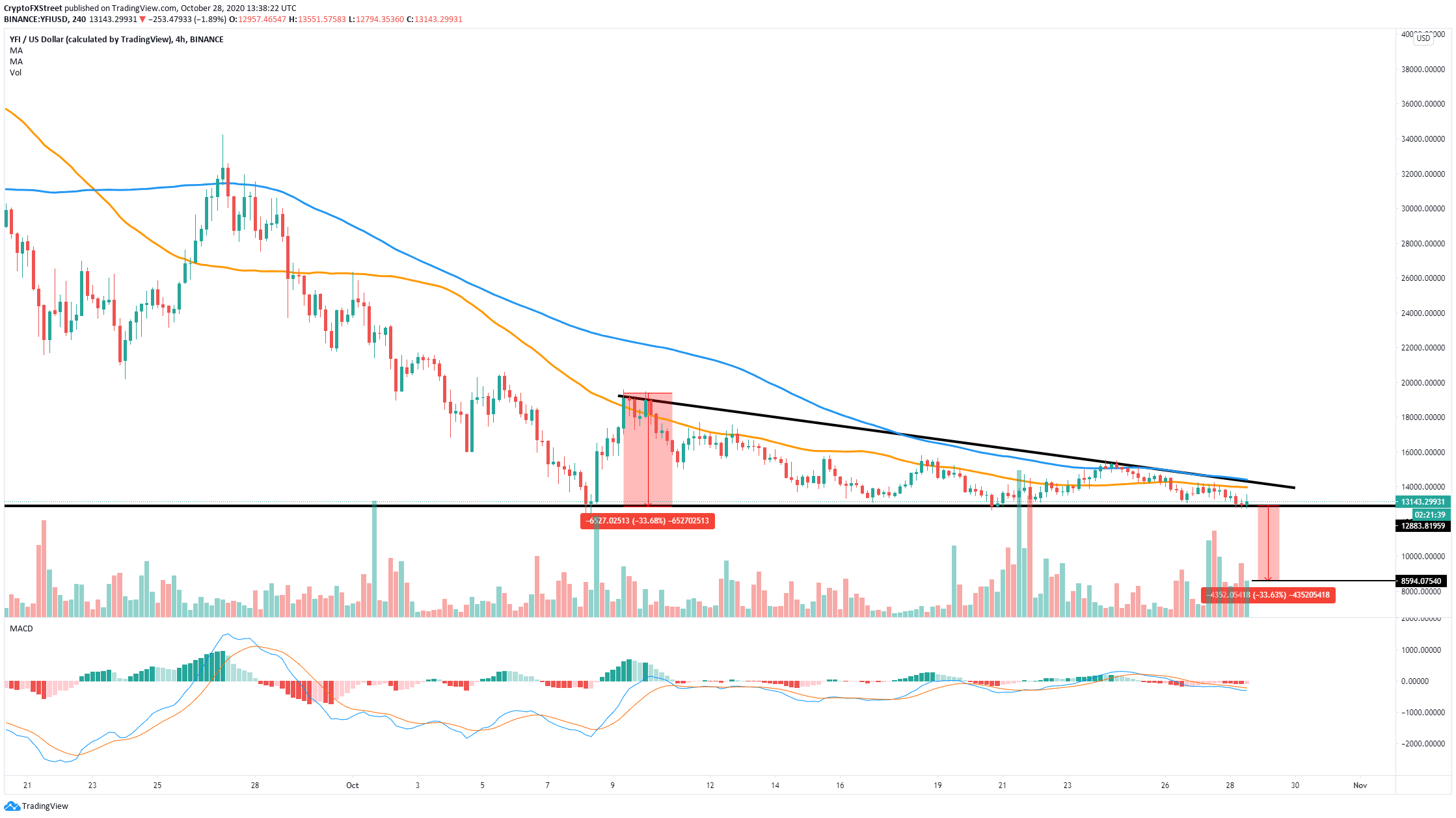

A breakout below the 50-SMA at $14,000 could drive YFI down to the support level at $13,000, which coincides with the lower Bollinger band. The 100-SMA has rejected the price already, which is now trying to hold the 50-SMA.

The 4-hour chart shows a strong resistance level in the form of the 100-SMA at $15,000, which almost coincides with the upper Bollinger band. The other side of the coinĭespite the bullish breakout above the descending triangle pattern, bulls are still facing some hurdles above. This metric adds even more fuel to the recent bullish breakout. YFI Holders DistributionĪdditionally, looking at the holders distribution chart provided by Santiment, we can observe a decent spike in the number of whales holding between 100 and 1,000 coins, jumping from 14 on October 16 to 18 currently. Before the final price target of $20,000, bulls are eying up $17,000, which is the 50-SMA on the 12-hour chart. It also seems that the Bollinger Bands have squeezed significantly over the past three days, indicating that a major move is underway. The MACD has remained bullish since October 8, and the RSI is not even close to overextension. Although YFI hasn’t seen a lot of continuation just yet, the breakout is notable. On the 12-hour chart, a descending triangle formed since October 8 has just been broken. After losing close to 70% of its value over one month, the digital asset seems ready for a massive rebound. YFI has been trading inside a massive downtrend since September 12 and formed a head and shoulders pattern that broke bearishly. Continuation of the recent bullish breakout can drive YFI towards $20,000.YFI is currently trading at $14,447 and has broken out of a significant 12-hour chart pattern.

0 kommentar(er)

0 kommentar(er)